Value for Our Customers

(1) For Financial Institution Participants

1. Independent from SWIFT, it enables simultaneous payment, clearing and

settlement.

2. Boost settlement efficiency and deliver optimal remittance path for network

participants swiftly and automatically via its flat network structure.

3. Downsize settlement fund liquidity and complete the maximum capital

flow with the minimum credit amount.

4. Does not occupy settlement funds but only controls the amount of

settlement funds.

5. Substantially cut settlement costs.

6. Full business scenarios of cross-border foreign currency, cross-border

local currency, domestic foreign currency and domestic local currency are

provided to prepare commercial banks to integrate settlement channels globally.

7. No restrictions on currency and enable participants to develop cross-border

local currency settlement.

8. More secure

clearing and settlement services.

9. Support integrated DVP/PVP service.

10. Support real-time PVP service to avoid exchange loss.

11. Support independent management of transaction data.

(2) For Bank Customers

1. 7* 24 real-time

cross-border settlement service.

2. Remittance received

in full amount and the cost is transparent, fixed and predefined.

About Our Product

Product Positioning

As the new generation Global Settlement

Network, GSN is an important financial infrastructure for trade settlement and

inter-bank transfer. Through the globally deployed network of message

forwarding platforms and GSN processing centers worldwide, banks with regional

clearing capacity can be upgraded to financial institutions with global

clearing capacity.

Based on flat distributed network, block

chain and other state-of-the-art technologies, GSN bridges a fast, efficient,

low-cost and secure financial highway between countries, and explores the new

business of developing regional clearing and settlement network. The aim is to

achieve global peer-to-peer (P2P), "7*24" (24 hours a day, 7 days a

week), multi-currency, gross fund clearing for cross-border trading enterprises

and individuals.

The GSN global clearing network adopts an

innovative flat distributed clearing mode, namely, two tiers of settlement

banks and commercial banks, which can greatly shorten the clearing path and

boost clearing efficiency.

Our Service

Message Forwarding: Provide fast, peer-to-peer (P2P), real-time, and efficient

delivery services between cross-border participants.

Main Business Modules: Inter-bank cross-border payments and trade finance among other

business services.

Settlement Service: Provide real-time clearing of payment businesses and complete

deferred fund delivery between financial institutions with no need to open

unified reserve accounts.

Liquidity Risk Control: Draw on international experience and proceed from the management

practice of financial institutions, provide functionalities such as clearing

window, business queuing and matching and real-time liquidity query.

GSN Business Ecosystem

Servicing Entities

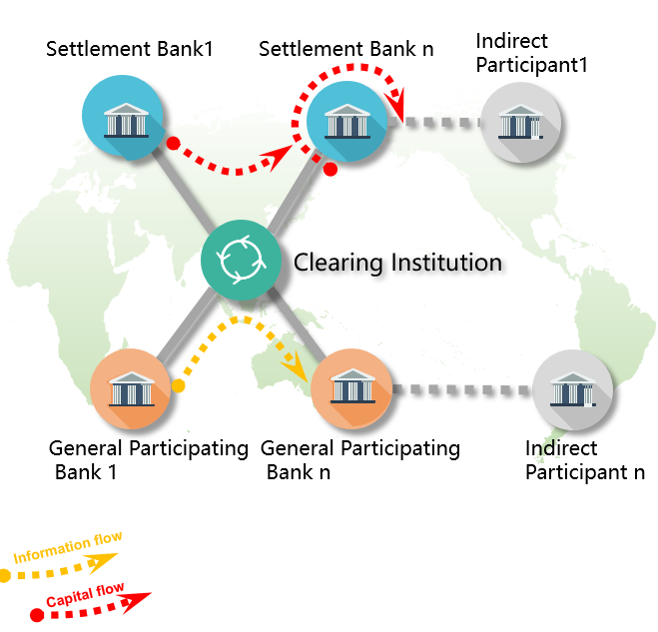

Clearing Institution: Unique in the network and is initiated and established by several

major participants. The Clearing Institution is responsible for intra-network

message forwarding, business sorting, clearing, clearing network operation,

etc.

Settlement Bank: There are multiple settlement banks in the network, which shall

join after being approved by GSN and shall be responsible for the settlement of

funds between the reserve accounts of General Participating Banks. The

Settlement Banks may also assume the role of General Participating Banks.

Settlement Banks are directly connected to the network.

General Participating Bank: There are multiple General Participating Banks in the network,

which are directly or indirectly connected to the network. They are responsible

for settlement for customers, business message sending and receiving, internal

accounting processing, etc.

Indirect Participant: It refers to a commercial bank that has not joined the GSN

clearing network but has the unique participant identification code assigned by

GSN and can enjoy funds transfer and other services via their corresponding

direct participants.

GSN Technological Features

1. Base the division and design of micro-services on DDD (Domain-Driven

Design) and establish the mapping relationship between domain objects and code

objects. Map and bind the business architecture and system architecture to

realize the rapid response to business changes.

2. The system

adopts distributed micro-service architecture to meet non-functional

requirements such as high performance, high availability, extensibility and

easy scaling.

3. Self-established

CA, using the digital certificate hierarchical mechanism, transaction sign&

verify and encrypted data transmission, ensures transaction security.

4. Based on

the consensus blockchain network, the digital signature of transaction

information is saved in the blockchain distributed ledger to realize

transaction traceability, non-repudiation and tamper-proof.

5. Based on

the disaster recovery plan of two places and three centers in the same city, it

boasts advantages of Multi-active Across Data Centers while avoids its

disadvantages.

6. Inexpensive

server with X86 architecture is adopted instead of costly minicomputer, open

source rather than commercial message-oriented middleware, together with open

source database other than commercial database, etc., are but few exemplars of embracing

open source and advocating independence and controllability.